Umbrella Payroll Services

The Umbrella Payroll model is a cost-effective alternative to PAYE.

At Bishop Oak, we provide a range of outsourced payroll services including Umbrella Payroll. Let us take the stress of payroll away so you can focus on what you do best.

What is Umbrella payroll?

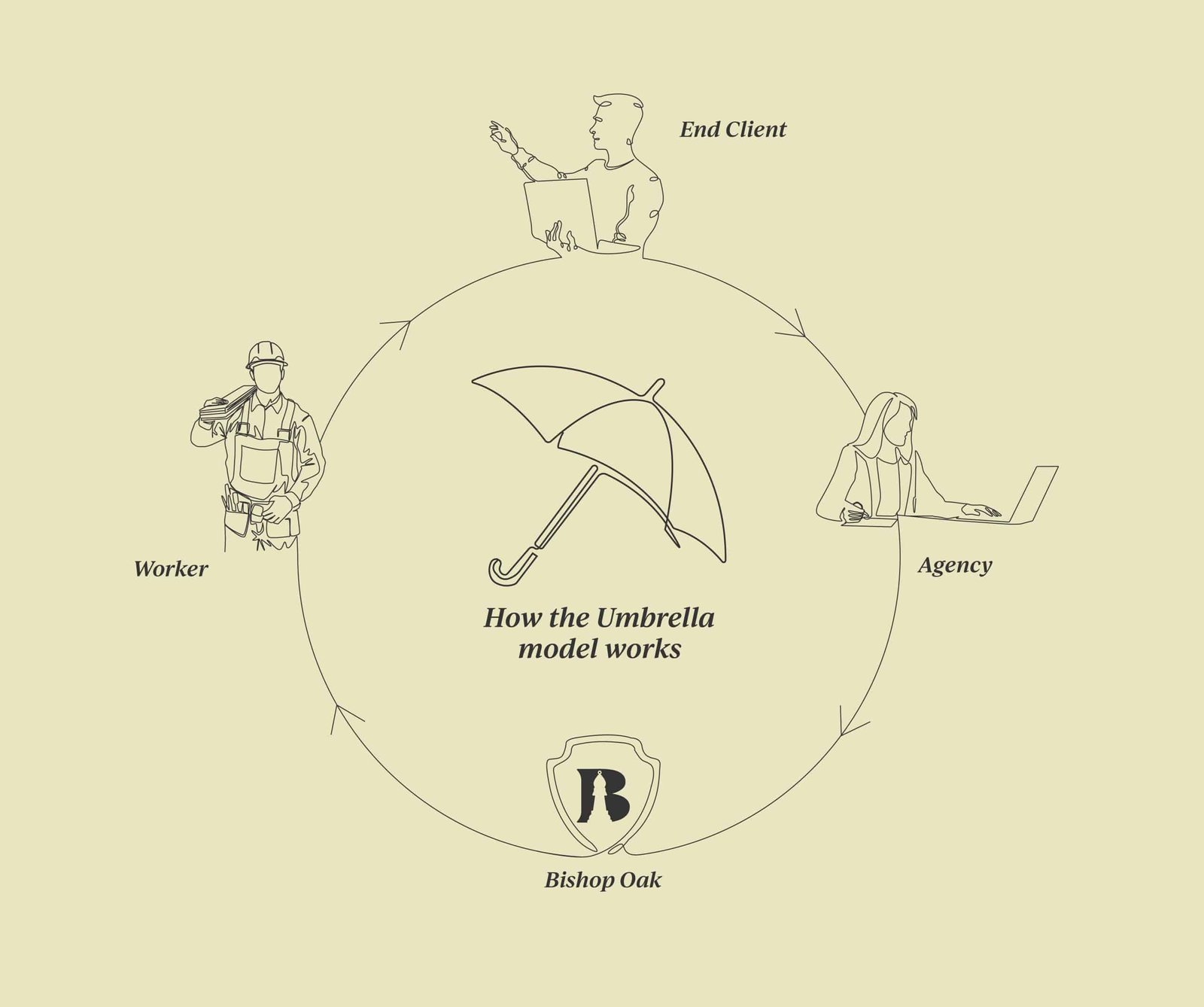

Umbrella payroll refers to a system in which individuals working as contractors or freelancers are employed by an intermediary company, commonly known as an umbrella company. Under this arrangement, the umbrella company becomes the employer of the contractors, handling various administrative tasks such as payroll processing, tax deductions, and National Insurance contributions.

Contractors and workers submit their timesheets and expenses to the umbrella company, which then calculates their pay and deducts applicable taxes and fees. This approach simplifies the administrative burden for contractors, as they do not have to establish their own limited company or handle complex payroll procedures.

Who uses Umbrella?

Umbrella payroll models are typically used by agencies, especially those in the recruitment sector. However, lots of sectors and businesses can utilise Umbrella to save money and time.

The process of using the Umbrella payroll model is quite straightforward. An agency sets up a contract with the umbrella company that outlines the areas the umbrella company is responsible for. These responsibilities will include employing workers and paying their wages in line with all relevant information and legislation as well as then invoicing the agency for the time each worker has worked.

What are the benefits of Umbrella payroll?

There are several benefits to choosing Umbrella as the payroll model for your business, they include:

- Reducing employment costs – NI not charged to the business

- Outsourcing admin saving your business time and money

- Contractual and legal obligations passed on to the Umbrella company ensuring your compliance with regulation

- Insurance cover as many Umbrella companies will also include some level of insurance in their packages

- Flexibility for you and your workers as Umbrella companies will be used to working with workers on both long and short term contacts

What employment rights does a worker have if I use the Umbrella payroll model?

It is important to note that a worker has the same rights as an employee when being paid through an Umbrella company. These rights include:

- An employment contract

- Be paid national minimum wage or national living wage on time and in full, terms should be agreed by all parties in the key information document

- A holiday entitlement and paid holiday

How do workers get paid if I use Umbrella payroll?

You pay the umbrella company the assignment rate and then the umbrella company will make several deductions to work out the worker’s gross pay. The breakdown of the deductions can be found on the reconciliation statement and will usually include:

- Umbrella company operating costs, also known as margin

- Employer National Insurance contribution

- Employee workplace pension contribution

- Holiday pay

- Apprenticeship levy where applicable

It is the responsibility of the Umbrella company to ensure workers are paid correctly and on time.

If you’d like to learn more about Umbrella, please contact our friendly team who will be happy to help.

Latest News & Insights

Why Compliance Matters: Staying Up-to-Date with Payroll Regulations

As a business owner or manager, it is crucial to prioritise

Everything You Need to Know to Get Started with Self-Employment

Self-employment is an exciting opportunity for individuals who want to take

Mistakes to Avoid When Being Self-Employed

Self-employment can be a great way to gain more control over

Join Our Webinar Series

Discover how to make the most of government-funded retrofit schemes and explore the combined support services offered by Bishop Oak in partnership with Healthy Homes Solutions. Our expert-led webinars provide everything you need to know to navigate these schemes effectively, improve energy efficiency, and transform homes into sustainable, healthy spaces.

Don’t miss out – sign up today and take the first step towards energy-efficient solutions!